After filling in the form, we'll give you a whistle stop tour of our platform, showing you how easy Payroll Giving is to get set up.

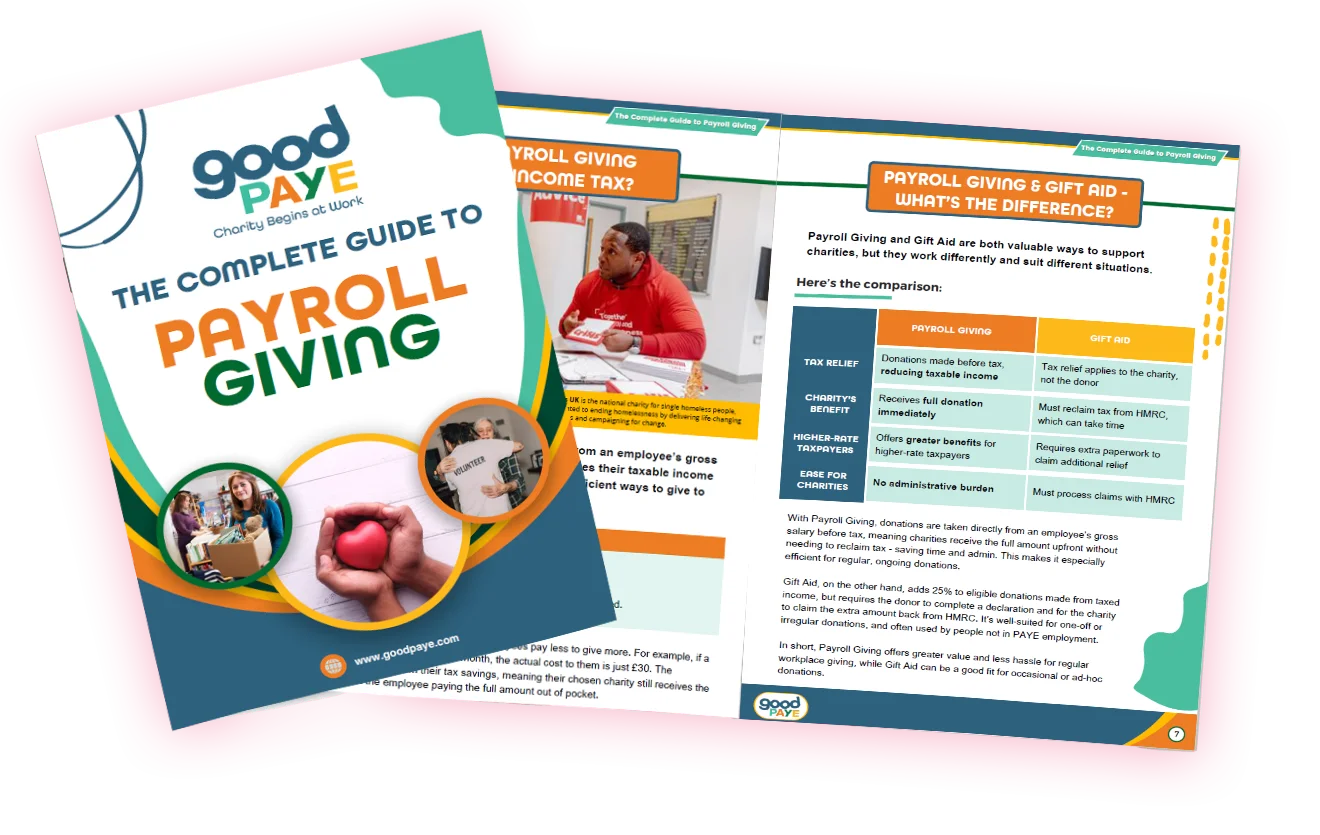

![]() Payroll Giving Explained: Everything employers need to know >>

Payroll Giving Explained: Everything employers need to know >>

Calls for UK businesses to step up their charitable giving this Payroll Giving Month

- Almost half (46%) of all charities are more in demand than this time a year ago.

- 25% of the UK population gave less to charity in December 2023 than the previous year, representing a shortfall of funding of £3.2 billion.

- Cost-of-living crisis causing 54% of parents to cut back on food spending for their family over the past 12 months, with a quarter (26%) selling possessions to feed the family.

- Charity reserves are being used to cover income shortfall.

- Only one in five organisations currently offer a payroll giving scheme.

Businesses across the UK are being urged to step up their charitable giving, as research shows nearly half (46%) of charities are more in demand than a year ago, with 25% of the population cutting back on donating to charity due to the cost-of-living crisis.

Charitable giving has taken a steep dive as more and more families struggle to stay afloat themselves. Latest research reveals that there has been a shortfall of £3.2 billion in public donations since December last year.

A group of charities and organisations such as Barnardo’s, the Chartered Institute of Payroll Professionals (CIPP) and the Chartered Institute of Fundraising (CIOF) are amongst payroll giving agencies and professional fundraising bodies who have come together this Payroll Giving Month in February to raise the profile of the issue and to ask businesses to step in and help.

Research shows only one in five organisations currently offer a payroll giving scheme to their staff. Payroll Giving (sometimes known as Give as You Earn) is an easy and tax-efficient way of making regular donations to charities straight from employees’ gross pay.

Throughout February, companies are being urged to explore and learn about payroll giving through webinars, events and resources that will be shared across social media using the hashtag #PayrollGivingMonth.

With many payroll giving organisations also offering matching incentives, the month serves as an ideal time for companies to launch a scheme internally. To launch a payroll giving scheme, contact [email protected]

Terry Stokes, Senior Workplace Giving Manager at Barnardo’s said:

In a time when charities face unprecedented challenges, Payroll Giving Month is a timely response to the urgent need for support. Recognising the plateau in payroll givers in recent years, this initiative serves as a powerful catalyst for change, acknowledging the heightened demand for charitable aid.

We are currently seeing more than one in four children in the UK now live in poverty and we need to find more funding somehow to help them. As Vice Chair of the Payroll Giving Special Interest Group, I’ve personally witnessed the positive impact that payroll giving donations can have on the charity sector. It’s an opportunity for more companies to consider.

Barnardo’s ‘Impact of Cost-of-Living Report’ reveals that 54% of parents have cut back on food spending for their family over the past 12 months, with a quarter (26%) selling possessions to feed the family.

Other research shows that charity reserves are being used to cover income shortfall.

Samantha O’Sullivan, Policy Lead at CIPP added:

Payroll Giving exemplifies how payroll and HR can be a force for good within an organisation, aligning business goals with societal impact. Offering a payroll giving scheme is a fantastic way for employers to facilitate their employers to give to charity in a financially beneficial way, not only to themselves, but also to their charity of choice.

Rob Cope, Executive Director Membership & Operations at the Chartered Institute of Fundraising said,

The Chartered Institute of Fundraising is fully committed to supporting the growth of payroll giving. With only one in five organisations currently offering a scheme, Payroll Giving Month holds tremendous potential to significantly increase the amount of money donated to charity.

Payroll Giving is quick to implement, simple to administer and generates huge social impact. If your organisation is interested in setting up a scheme, or would like to know more information, drop us an email at [email protected]

Help your employees donate more to environmental charities through Payroll Giving

Download your free guide guide here

Everything employers need to know about running a payroll donation scheme.