After filling in the form, we'll give you a whistle stop tour of our platform, showing you how easy Payroll Giving is to get set up.

Payroll Giving Explained: Everything employers need to know >>

What is Payroll Giving? How To Give As You Earn To Charity

Payroll Giving schemes are a tax-efficient way for employees to donate to charity. Sometimes referred to as Give As You Earn (when operated through CAF) or Workplace Giving, this benefit allows employees to make donations to chosen charities directly from their salary before tax is calculated, which ensures that charities receive more while employees pay less.

In this article, we’ll explore how Payroll Giving works, its benefits and show you how to set up a scheme in your organisation.

Skip to:

What is Payroll Giving?

Payroll Giving is a UK government-approved scheme that lets employees donate to charity directly from their salary before tax.

Through this simple system (which is also known as Give As You Earn (GAYE)) employees can regularly support their chosen charities while benefiting from immediate tax relief on each donation.

For charities, Payroll Giving means receiving the full donation amount automatically, without the need to reclaim tax through Gift Aid. Employers benefit too, by demonstrating social responsibility and encouraging a culture of giving at work.

It’s an efficient, tax-effective way to support good causes. Making it a genuine win-win for employees, employers and charities alike.

Employers benefit from Payroll Giving schemes as well. Offering such perks demonstrates a commitment to corporate social responsibility (CSR), which can enhance their reputation and appeal to socially conscious job seekers. Businesses with Payroll Giving schemes make a positive societal impact and this particular benefit is a powerful way to:

- Enhance employee engagement

- Strengthen the organisation’s reputation

- Support meaningful causes

By making it easier for employees to give, employers foster a culture of generosity and compassion.

Businesses with active Payroll Giving schemes can even apply for the Payroll Giving Quality Mark. This certification highlights their dedication to philanthropy and can be used as a promotional tool to attract talent who value corporate responsibility.

Watch Our On Demand Webinar For A Quick Overview of Payroll Giving

How Does Charity Payroll Giving Work?

Here’s how Payroll Giving operates:

- Employee Participation: Employees decide how much they want to donate and which charities they want to support.

- Payroll Deduction: The chosen donation amount is deducted from the employee’s gross salary, before income tax is applied. This means the employee’s taxable income is reduced, saving them money on tax.

- Employer and Payroll Giving Agency: Employers work with a Payroll Giving Agency (PGA) to manage the scheme. The employer forwards the deducted amounts to the PGA, which distributes the funds to the chosen charities.

- Charities Receive Full Donations: Charities receive the donations directly from the PGA without needing to reclaim tax. This provides them with immediate, hassle-free support.

To further streamline the process, organisations like GoodPAYE also provide digital platforms where employees can track their donations and make changes to their charitable preferences at any time. Making it a breeze for employers to administer.

Does Payroll Giving Reduce Employee Income Tax?

Absolutely. Payroll Giving reduces an employee’s taxable income because donations are deducted before tax.

This means that:

- Basic-rate taxpayers (20%) save 20p for every £1 donated.

- Higher-rate taxpayers (40%) save 40p for every £1 donated.

- Additional-rate taxpayers (45%) save 45p for every £1 donated.

These tax savings make Payroll Giving a cost-effective way to contribute to charity while lowering personal tax bills.

Check out our Payroll Giving Tax Calculator to see exactly how much your employees can save.

For example, if an employee donates £50 a month through Payroll Giving and they are a higher-rate taxpayer, the cost to them is just £30.

The remaining £20 comes from their tax savings, meaning their generosity has an even greater impact without additional personal expense.

Do Charities Receive All Of The Donation Money?

Since the donations are taken from gross pay, there are no deductions or administrative fees on the charity’s end. However, there are admin fees involved with Payroll Giving, which are automatically applied to the employee’s donation. These fees are minimal. Employers have the opportunity to cover these costs to ensure all donations go to charity.

This is a significant advantage over Gift Aid, where charities must apply to HMRC to reclaim tax on donations – which can take time and add to administrative costs. Additionally, Payroll Giving provides charities with a predictable stream of income, as regular donations help them plan and allocate resources effectively.

Payroll Giving also supports charities large and small.

This helps smaller charities – which may lack the resources to administer tax reclamations through Gift Aid – to raise much needed funds. It’s fully inclusive, with every UK charity free to benefit. Which allows employees to support niche causes or grassroots organisations that align with their personal values.

The employers’ guide

to Payroll Giving

Everything employers need to know about running a payroll donation scheme.

- How donations reduce employee income tax

- Donation examples and FAQs

- Why this delivers more to charities than Gift Aid

Download your free guide

Examples of Charitable Payroll Donations

To illustrate how Payroll Giving works for different tax brackets, here’s a table showing the cost of donations and the amount charities receive:

| Monthly Donation | Cost to 20% Taxpayer | Cost to 40% Taxpayer | Cost to 45% Taxpayer | Charity Receives |

| £10 | £8 | £6 | £5.50 | £10 |

| £25 | £20 | £15 | £13.75 | £25 |

| £50 | £40 | £30 | £27.50 | £50 |

As the table shows, higher-rate taxpayers can give more to charity at a lower personal cost compared to basic-rate taxpayers. This makes Payroll Giving particularly attractive to those in higher tax brackets.

Additionally, many employers offer matching donation schemes. For instance, if an employee donates £25, the employer might match this amount, doubling the impact of the donation. This adds even more value to Payroll Giving schemes.

Is Payroll Giving Better Than Gift Aid?

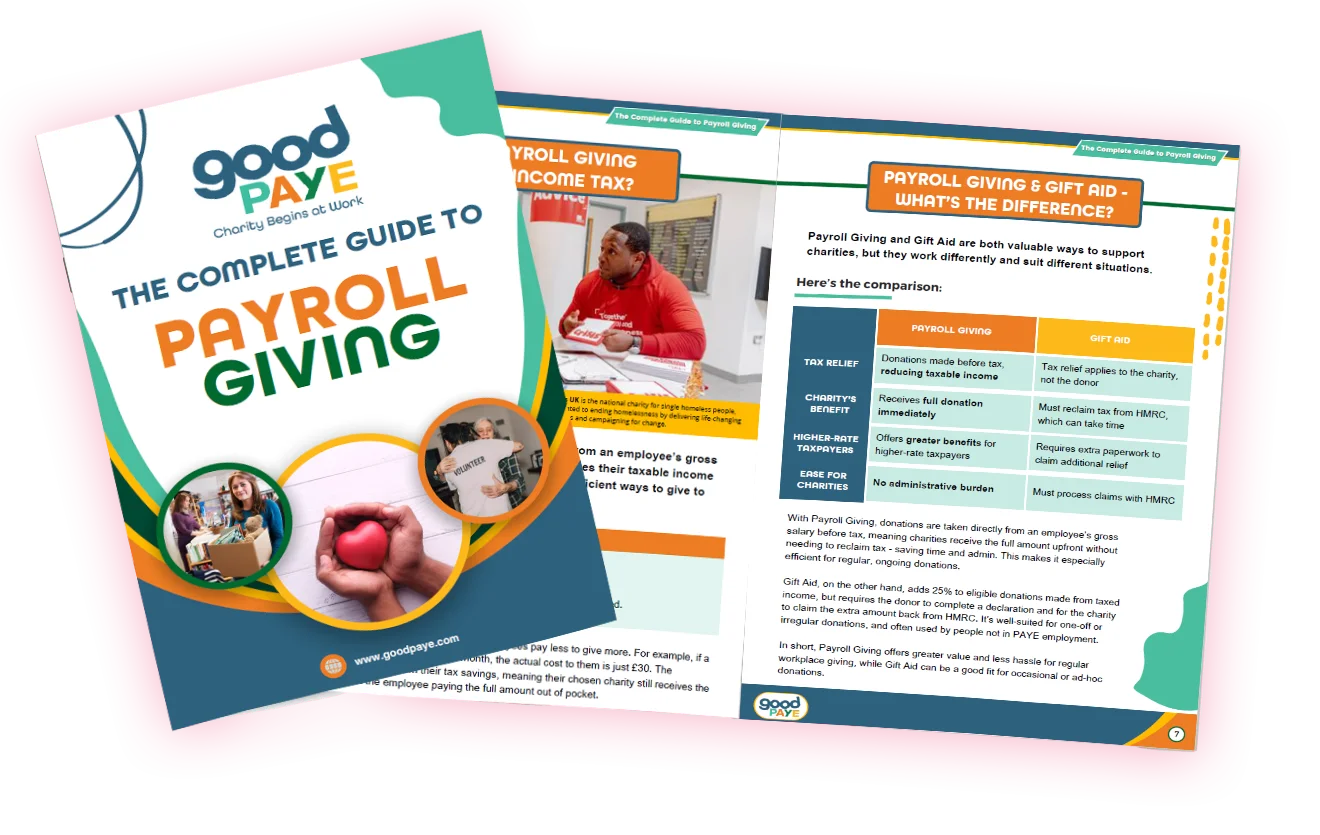

Payroll Giving and Gift Aid are both beneficial but serve different purposes.

Here’s a comparison:

| Feature | Payroll Giving | Gift Aid |

| Tax Relief | Donations made before tax, reducing taxable income | Tax relief applies to the charity, not the donor |

| Charity’s Benefit | Receives full donation immediately | Must reclaim tax from HMRC, which can take time |

| Higher-rate Taxpayers | Offers greater benefits for higher-rate taxpayers | Requires extra paperwork to claim additional relief |

| Ease for Charities | No administrative burden | Must process claims with HMRC |

So Payroll Giving often provides better value. With charities benefiting from receiving funds instantly without additional administrative steps.

Gift Aid, however, can be advantageous for one-off or irregular donations, and for those that are not in full-time employment.

Both systems are valuable tools for supporting charitable causes and which you choose depends on individual preferences and circumstances.

Which Charities Can You Support?

One of the great features of Payroll Giving is its flexibility, as employees can donate to any UK-registered charity.

This includes:

- Local community organisations

- National charities

- International aid organisations

- Religious groups

- Educational trusts

Some employers also allow employees to support non-charitable organisations, such as sports clubs or cultural groups, provided they meet the scheme’s eligibility criteria. This broad scope ensures that every employee can find a cause that they hold dear. At GoodPAYE, we partner with over 200 charities, which are readily available to select on our platform. However, employees can support any UK charity of their choice. If their preferred charity isn’t on our list of 200, they can simply type it into their application, and we’ll take care of the rest by contacting the charity and setting it up on their behalf.

How to Set Up A Payroll Giving Scheme

Setting up a Payroll Giving scheme is really simple. Here’s how employers can get started:

- Partner with a Payroll Giving Agency (PGA)

Employers need to choose an HMRC-approved PGA to manage the scheme. These agencies handle the distribution of donations to charities, ensuring compliance and eliminating the admin burden for Payroll/Finance teams.

(Working with GoodPAYE for your Payroll Giving scheme means we’ve got this bit covered for you, so no need to browse through the HMRC website!)

- Promote the Scheme to Employees

Communicate the benefits of Payroll Giving to employees. Highlight the tax savings, the flexibility to choose charities and the simplicity of the process. Use internal newsletters, posters or team meetings to raise awareness.

- Integrate with Payroll Systems

Work with your payroll department to set up pre-tax deductions. Any modern payroll systems can accommodate these adjustments easily.

(With GoodPAYE, a single export from your Payroll System and just one bank transfer is all you need to administer. Here’s how it works).

(Team up with GoodPAYE and we’ll provide you with monthly comms, webinars and in-person visits to boost uptake).

- Encourage Participation

Make it easy for employees to sign up by providing forms or online portals. Offering incentives, such as matching donations, can also boost participation.

- Monitor and Support

Regularly review the scheme’s uptake and address any employee queries along the way.

Be sure to playback the total donated and the impact that’s had on chosen charities to maximise employee enthusiasm for the scheme.

Employers can also track participation rates and celebrate milestones, such as total donations reaching a specific amount. This fosters a sense of collective achievement and motivates ongoing participation.

Give As You Earn & Let’s Get Charitable Donations Flowing

Payroll Giving is an excellent way for individuals and organisations to make a positive impact. It simplifies the donation process, maximises tax efficiency and ensures charities receive much-needed support month-in, month-out.

Whether you’re an employer looking to set up a scheme or an employee eager to give as you earn, Payroll Giving offers a practical, impactful way to positively impact the lives of others.

Start making a difference today by exploring Payroll Giving for your workplace. Together, we can change the world while we work.

The employers’ guide

to Payroll Giving

Everything employers need to know about running a payroll donation scheme.

- How donations reduce employee income tax

- Donation examples and FAQs

- Why this delivers more to charities than Gift Aid

Download your free guide