After filling in the form, we'll give you a whistle stop tour of our platform, showing you how easy Payroll Giving is to get set up.

![]() Payroll Giving Explained: Everything employers need to know >>

Payroll Giving Explained: Everything employers need to know >>

Embracing tech to achieve impactful change in the charity sector

Meet Tara Honeywell, Head of Commercial Ventures at Barnardo’s, a UK charity dedicated to supporting and nurturing vulnerable children. In our recent chat with Tara, we discussed the critical need for innovation in the charity sector and the importance of embracing technology to achieve impactful change. Read on to learn more about our insightful conversation with Tara.

Why is there a need for innovation and change within the charity sector?

I think there’s a huge need for innovation and change within the charity sector. If we take Barnardo’s for example, it’s 155 years old. The needs of children and young people are ever complex, but the world that we operate in has changed, technological advances has changed, the way we interact and support the needs of children and young people has changed – and also the way that people typically donate and give to charities has changed.

So for us to stay relevant to meet the demands on our services for children and young people, we need to think really differently about how we continue to meet those demands and to raise those funds. And the only way to do that is to take an innovative approach to things that we’ve been doing for a number of years.

Why should charities embrace technology?

I think traditionally charities have been fairly slow to adopt new technologies. I also think often that sometimes taking the resource to focus on new technologies can be seen to detract either from a resources perspective, financial perspective, and from the work that we do on the ground. And charities first and foremost need to focus on supporting the communities that they work with.

So I think it’s really important that charities understand the value that new technologies can bring, both in terms of how it can enable them to support the groups of people that they work with – both in terms of how it can enable them to further enhance and support their mission more generally, and also in terms of how they can run their organisations in a more efficient and effective manner, all of which will ultimately enable more money to go to our services on the ground.

What do you think the challenges of fundraising faces over the next the next 12 months?

Naturally the biggest challenge is the macroeconomic landscape that we’re all living in at the moment and the uncertainty that that brings. People are going to be strapped for cash to pay their shopping and utilities. And I think we have to be really mindful of that in terms of charities.

But I do also think that a lot of the traditional fundraising channels haven’t necessarily been working as good as they used to for some time. So I think there’s the longer term ambition to really think differently about fundraising, interlinked with the technology that’s available, the start-ups that already exist, to see how we can do things differently, which would be a challenge for us, whether we had this kind of cost of living backdrop or not.

I think that just because we have the cost-of-living backdrop gives you even more pertinence to try new things and see where we can look at increasing fundraising income when we’re no doubt going to see some of it fall off.

What do you think the potential impact is that Payroll Giving and GoodPAYE can have on the charity sector?

Well, £150 million worth of impact, I hope, in terms of the potential to increase the size of the Payroll Giving market. (In reference to GoodPAYE’s mission.) But I think the impact will come just through an increase in much needed funds. We are consistently being required to do more because of the state of the world that we currently live in. And yet it’s consistently harder to raise those funds through traditional fundraising means.

I think the fact that payroll giving is the most tax efficient way to give, and that it’s done without any administration required by you is hugely beneficial. Whatever you’re giving, you’re automatically giving a bonus to those charities.

Collectively to be able to bring £150 million into the sector is a huge opportunity for us at a time when traditional fundraising channels are becoming ever more challenging. With just 4% of UK employees donating through payroll giving, it is really untapped. There’s a real opportunity whilst we’re in this position – where it’s quite hard to exploit a lot of these traditional channels – for us to really exploit payroll giving. The impact could be phenomenal.

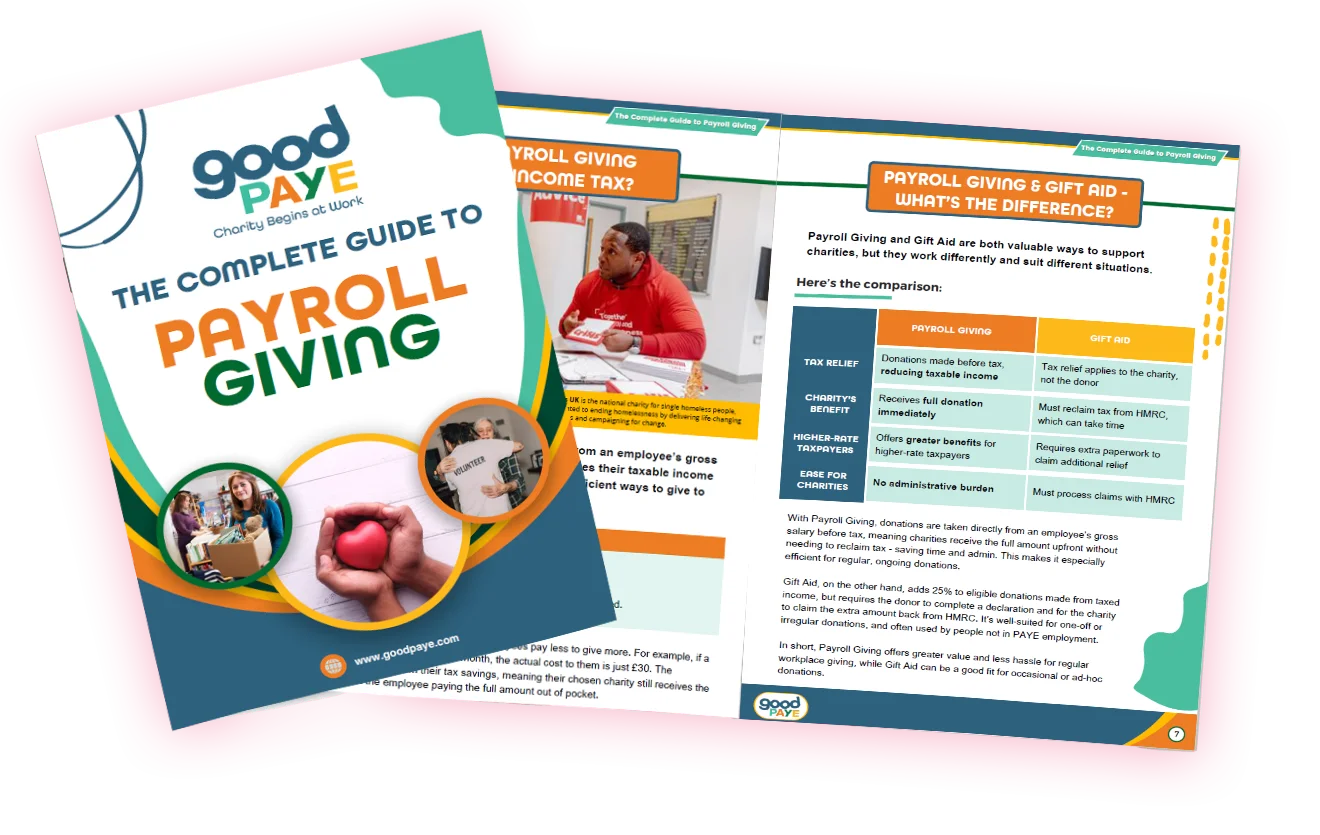

Download your free guide to Payroll Giving

Everything employers need to know about running a payroll donation scheme.